There seems to be a big disparity between gold shares and gold bullion. While gold bullion and spot gold have been increasing around 12 percent this year, shares of gold miners have been falling around 15 percent. In fact the smaller gold miners are down much more, around 40 percent.

This gulf between the price of gold and the price of gold shares has caused acute pain for some of the biggest names on Wall Street including John Paulson, George Soros, David Einhorn, Seth Klarman and Thomas Kaplan, a few of which went for gold mining shares instead of gold bullion.

In an interview recently with King World News, Egon von Greyerz, founder and managing partner at Matterhorn Asset Management out of Switzerland, spoke about the big drop in gold recently. "... I’m not really surprised because last time I talked ... I did say gold could go down to $1,550 support and maybe even $1,420. In my view that would be quite normal in a very thin market and I said that would probably happen by the year end."

"But this is all a thin paper market; we have not seen one single physical seller of gold or silver at these prices. So it’s just manipulation and panic in a paper market at the year end. Of course, it's easy for anyone who wants to intervene to push the price down even further in a thin market. So I think that’s what’s happening and I wouldn’t worry the slightest bit. "

When asked where he sees gold heading in 2012, von Greyerz responded, "I wouldn't be surprised to see several thousand dollars (for gold), let’s say between $3,000 and $5,000 next year. I see that as the next move and fundamentally everything supports that. "

Getting back to the subject at hand, possibly the slow in gold mining stocks is influenced by concerns mining costs are rising and governments are beginning to see resource stocks as a easy tax target. This plus the fact that some gold miners also dabble in other resources which can affect the share price adversely. In addition mining companies sometimes diversify their profits into areas not related to gold.

"When you sell your portfolio, you say, well, what's cyclical, and that includes mining stocks," says Patrick Chidley an analyst at HSBC. He called gold-mining stocks a "buying opportunity" in a June research report.

For example, one long time gold investor, Mr. Kaplan, who administers a family fund held over 50 million shares in Novagold Resources Inc., whose stock dropped a massive 40% this year. Mr Kaplan also owns over 60 million shares of Gabriel Resources Ltd., A mining company with a huge gold project in Romania, down more than 20% this year.

Although these declines have cost Mr. Kaplan about $430 million this year, he bought in at price considerably lower than today’s figures and is still holding huge profits on gold.

"Our focus is on adding to our holdings, especially mines and equities in safe" jurisdictions, says Mr. Kaplan, who believes gold shares are due for a rebound.

Seth Klarman's Baupost Group, a value-oriented firm, owned nearly 13% of Gabriel at the end of the third quarter. He added to his position through much of this year, according to regulatory filings. Mr. Klarman also bought five million shares of Novagold in the third quarter.

Mr. Einhorn is another investor who says they are holding on to gold mining stocks. "It has reached the point where gold mining stocks should do well even in a stable gold market," Mr. Einhorn wrote in his most recent letter to investors. "We expect the price of gold to appreciate further, so gold miners should do even better."

Currently at the end of 2011, AngloGold is down about 14% so far this year. Gold Fields Ltd is down about 14% in 2011. Barrick Gold, fell around 14%.

"It's a little perverse that gold loses value when there's a currency crisis occurring in Europe" that should spark interest in gold", says Darren Pollock., who helps run Cheviot Value Management, LLC in Los Angeles and has been a fan of gold shares.

So while gold shares have, for the most part, fallen gold bullion has continued to climb and looks set to continue in the new year 2012.

Thursday, December 29, 2011

Tuesday, December 27, 2011

China Tightening Control over Gold Exchanges

China is moving to tighten controls over the mushrooming of small gold exchanges operating around the provinces.

The Peoples Central Bank (PCB0 has restricted gold spot trading to the Shanghai Gold Exchange and the Shanghai Futures exchange, with unauthorized exchanges ordered to stop trading.

According to the World Gold Council, China has overtaken India in the third quarter of 2011 as the largest gold jewelry market in the world. Gold bullion imports from Hong King into China increased by over 50 percent to a all time record in October of the year.

"It's part of a concerted effort to crackdown on commodities trading on illegal platforms, including gold," Roland Wang, general manager at the World Gold Council in Beijing, recently commented. "I don’t think it’s going to affect China's gold consumption or imports, because these speculative trades rarely involved the physical deliveries of gold in the first place."

"No local authority, institution, or individual is allowed to set up gold exchanges," said the notice dated December 20 and jointly issued by the People's Bank of China, the Ministry of Public Security, and other regulators.

"Gold is considered a form of currency and is an important component of central banks’ foreign reserves," The statement said "Gold has to be traded on exchanges approved by the State Council and other related regulators in order to safeguard social stability and economic and finance safety. The central bank will also proceed with opening up the gold market and steadily lead it onto a path of "healthy development," it said.

The notice, published on the central bank website, pbc.gov.cn stated that the Shanghai Gold Exchange and the Shanghai Futures Exchange are sufficient to meet domestic investor demand for spot gold and futures trading.

An official at the Beijing Gold Exchange Centre, who declined to be identified, told Reuters over the phone that the exchange has not received any detailed instructions.

"But the talk of a crackdown has been going on for a while," he said. "Of course this affects our business."

Sources: Reuters. Bloomberg

The Peoples Central Bank (PCB0 has restricted gold spot trading to the Shanghai Gold Exchange and the Shanghai Futures exchange, with unauthorized exchanges ordered to stop trading.

According to the World Gold Council, China has overtaken India in the third quarter of 2011 as the largest gold jewelry market in the world. Gold bullion imports from Hong King into China increased by over 50 percent to a all time record in October of the year.

"It's part of a concerted effort to crackdown on commodities trading on illegal platforms, including gold," Roland Wang, general manager at the World Gold Council in Beijing, recently commented. "I don’t think it’s going to affect China's gold consumption or imports, because these speculative trades rarely involved the physical deliveries of gold in the first place."

"No local authority, institution, or individual is allowed to set up gold exchanges," said the notice dated December 20 and jointly issued by the People's Bank of China, the Ministry of Public Security, and other regulators.

"Gold is considered a form of currency and is an important component of central banks’ foreign reserves," The statement said "Gold has to be traded on exchanges approved by the State Council and other related regulators in order to safeguard social stability and economic and finance safety. The central bank will also proceed with opening up the gold market and steadily lead it onto a path of "healthy development," it said.

The notice, published on the central bank website, pbc.gov.cn stated that the Shanghai Gold Exchange and the Shanghai Futures Exchange are sufficient to meet domestic investor demand for spot gold and futures trading.

An official at the Beijing Gold Exchange Centre, who declined to be identified, told Reuters over the phone that the exchange has not received any detailed instructions.

"But the talk of a crackdown has been going on for a while," he said. "Of course this affects our business."

Sources: Reuters. Bloomberg

Monday, December 12, 2011

Gold Coin fetches 7.4 Million Dollars

Blanchard and Co., the New Orleans-based coin and precious metals company recently brokered a deal in which extremely rare gold coin was sold for a record 7.4 million dollars.

The gold coin was sold to a Wall Street investment firm, the identity of which along with the seller, was not disclosed.

The rare Gold Coin was minted by Ephraim Brasher the goldsmith in 1787 and contains 26.66 grams of gold or just under an ounce. Worth only 15 dollars an ounce at the time the coin was struck, the gold value nowadays is something over 1500 dollars.

It is the only one of six coins of this type, called the doubloon due to its striking likeness to the Spanish doubloon. This one differs from the other five in that the distinctive hallmark is punch on the eagle's breast whereas the other five known doubloons have the hallmarked punched on the eagle's left wing.

The Brasher doubloon is considered the first American-made gold coin denominated in dollars. The U.S. Mint in Philadelphia did not begin striking coins until the 1790s, and foreign coins of various currencies were used in the nation's early years.

The gold coin, smaller than a half dollar must have looked very small indeed when it was delivered to the buyer in a large security truck after the sale.

The Brasher doubloon last changed hands in 2004 for $3 million. "We have known about it and coveted it for years," said Blanchard CEO Donald Doyle Jr.

Before the sale, the doubloon was sent to John Albanese of Certified Acceptance Corp. for grading and authentication, a consulting partner for Blanchard and well-established in the coin grading field. Albanese commented that he had previously made an offer of $5.5 million three years ago, but the offer was rejected at the time.

On the coin scale of 0 to 70 used in investment coin grading, Albanese graded the doubloon a 50. "It's a truly beautiful coin," he said.

Although such gold coins are few and far between, there are still many gold coins worth collecting. A modern day gold coin may not fetch $7.4 million dollars but it is still worth while buying a gold coin.

The gold coin was sold to a Wall Street investment firm, the identity of which along with the seller, was not disclosed.

The rare Gold Coin was minted by Ephraim Brasher the goldsmith in 1787 and contains 26.66 grams of gold or just under an ounce. Worth only 15 dollars an ounce at the time the coin was struck, the gold value nowadays is something over 1500 dollars.

It is the only one of six coins of this type, called the doubloon due to its striking likeness to the Spanish doubloon. This one differs from the other five in that the distinctive hallmark is punch on the eagle's breast whereas the other five known doubloons have the hallmarked punched on the eagle's left wing.

The Brasher doubloon is considered the first American-made gold coin denominated in dollars. The U.S. Mint in Philadelphia did not begin striking coins until the 1790s, and foreign coins of various currencies were used in the nation's early years.

The gold coin, smaller than a half dollar must have looked very small indeed when it was delivered to the buyer in a large security truck after the sale.

The Brasher doubloon last changed hands in 2004 for $3 million. "We have known about it and coveted it for years," said Blanchard CEO Donald Doyle Jr.

Before the sale, the doubloon was sent to John Albanese of Certified Acceptance Corp. for grading and authentication, a consulting partner for Blanchard and well-established in the coin grading field. Albanese commented that he had previously made an offer of $5.5 million three years ago, but the offer was rejected at the time.

On the coin scale of 0 to 70 used in investment coin grading, Albanese graded the doubloon a 50. "It's a truly beautiful coin," he said.

Although such gold coins are few and far between, there are still many gold coins worth collecting. A modern day gold coin may not fetch $7.4 million dollars but it is still worth while buying a gold coin.

Sunday, December 11, 2011

Gold backing loans

Gold is increasingly used to back loans in India. This is getting closer to the use of gold as a standard. More than Rs 50,000 million worth of gold is going to be used as collateral to get loans in a rapidly expanding gold loans market.

Industry estimates indicate that 200 or so tones of gold were used as collateral to raise loans over the past 12 months or so.

According to industry estimates, around 200 tonnes of gold have been used as collateral to raise loans by end November in 2011-12 fiscal.

"Gold loans help unlock value that is normally lying idle," said Siddhartha Sanyal, chief India economist, Barclays Capital.

"The organised gold loan market is just developing in India and can potentially be a source of liquidity, particularly for the middle and upper-middle class category," he added.

Citibank recently published a report that showed the organised gold loan market was worth over 100 million dollars in 2010 to 2011 and this market has been growing at over 30 percent per annum.

Gold has traditionally been used as a store of value but is a very secure asset.

"Propensity of default is also very low because the borrowers are emotionally attached to their gold," said V Sriram, CEO of IMaCS (ICRA Management Consulting Services).

The loans are very attractive for borrowers also, as the rates charged are lower than on unsecured personal loans.

The average rate of interest on loans issued against gold is 12-24% and time taken to process an application is at most 24 hours, whereas the rates on personal loans go up to 36% and processing takes much longer.

"This (organized gold loans) could further support consumption since gold is no longer considered an asset to buy and hold that is, a 'dead' asset and is now being used as collateral across income groups", said Rohini Malkani and Anushka Shah.

And what are the gold loans used for? "Gold loans are mostly raised for personal uses. For instance, in rural areas gold loans are used for agricultural purposes or to finance consumption.

At the very least it gives more value to gold in these frail economic times. India is the largest buyer of gold in the world and their demand is increasing exponentially.

Gold backing loans gives new support to the gold standard. Perhaps this will be a race between China and India.

Industry estimates indicate that 200 or so tones of gold were used as collateral to raise loans over the past 12 months or so.

According to industry estimates, around 200 tonnes of gold have been used as collateral to raise loans by end November in 2011-12 fiscal.

"Gold loans help unlock value that is normally lying idle," said Siddhartha Sanyal, chief India economist, Barclays Capital.

"The organised gold loan market is just developing in India and can potentially be a source of liquidity, particularly for the middle and upper-middle class category," he added.

Citibank recently published a report that showed the organised gold loan market was worth over 100 million dollars in 2010 to 2011 and this market has been growing at over 30 percent per annum.

Gold has traditionally been used as a store of value but is a very secure asset.

"Propensity of default is also very low because the borrowers are emotionally attached to their gold," said V Sriram, CEO of IMaCS (ICRA Management Consulting Services).

The loans are very attractive for borrowers also, as the rates charged are lower than on unsecured personal loans.

The average rate of interest on loans issued against gold is 12-24% and time taken to process an application is at most 24 hours, whereas the rates on personal loans go up to 36% and processing takes much longer.

"This (organized gold loans) could further support consumption since gold is no longer considered an asset to buy and hold that is, a 'dead' asset and is now being used as collateral across income groups", said Rohini Malkani and Anushka Shah.

And what are the gold loans used for? "Gold loans are mostly raised for personal uses. For instance, in rural areas gold loans are used for agricultural purposes or to finance consumption.

At the very least it gives more value to gold in these frail economic times. India is the largest buyer of gold in the world and their demand is increasing exponentially.

Gold backing loans gives new support to the gold standard. Perhaps this will be a race between China and India.

Buying Gold in Australia

A new reason to buy gold in Australia has emerged.

Just recently the Reserve Bank of Australia, who sets the benchmark interest rate, reduced the cash or official interest rate twice in a row bringing the official cash rate to 4.25 per cent at the time of writing this.

In November the RBA cut the Interest Rates by 0.25% to 4.50% In December by 0.25% to 4.25%. In his public statement, Governor Glenn Stevens noted, slowing growth in China and the global economy, "sovereign credit and banking problems in Europe" have caused considerable turbulence in financial markets, with financing conditions becoming "much more difficult".

"This, together with precautionary behaviour by firms and households, means that the likelihood of a further material slowing in global growth has increased".

Easing commodity prices as a result of these factors has taken pressure off CPI inflation rates, which "afforded scope for a modest reduction in the cash rate".

This means the banks have, somewhat reluctantly of course, had to follow suit and reduce the mortgage rate for home loans. This is very nice for those with a mortgage (I am one of those) but it also means the saving rate for bonds and general bank savings is also reduced. Not good for savers.

The banks will not continue to pay high interest on savings when the interest rate has been cut. These rates will be reduced also. Something not generally mentioned in the media but the banks do issue paid ads announcing the changes not long after the rate cut.

Along with general inflation this means the annual interest rate will remain below 5 or 6 percent a year. When you consider that gold appreciates in value by around 20 percent per year this certainly makes gold a much better 'investment' than cash in the bank.

In addition, interest accumulated at the bank attre3acts tax at the highest rate for the individual. This can be literally half the gains made from the interest on savings. Gold, on the other hand, does not attract any interest and so does not attract any tax. Ones asset is safe, both when one buys gold and even when one sells gold.

So to buy gold in Australia is now a much more attractive proposition than buying cash. Of course the banks won’t tell you that. Hardly in their interest, no pun intended.

Just recently the Reserve Bank of Australia, who sets the benchmark interest rate, reduced the cash or official interest rate twice in a row bringing the official cash rate to 4.25 per cent at the time of writing this.

In November the RBA cut the Interest Rates by 0.25% to 4.50% In December by 0.25% to 4.25%. In his public statement, Governor Glenn Stevens noted, slowing growth in China and the global economy, "sovereign credit and banking problems in Europe" have caused considerable turbulence in financial markets, with financing conditions becoming "much more difficult".

"This, together with precautionary behaviour by firms and households, means that the likelihood of a further material slowing in global growth has increased".

Easing commodity prices as a result of these factors has taken pressure off CPI inflation rates, which "afforded scope for a modest reduction in the cash rate".

This means the banks have, somewhat reluctantly of course, had to follow suit and reduce the mortgage rate for home loans. This is very nice for those with a mortgage (I am one of those) but it also means the saving rate for bonds and general bank savings is also reduced. Not good for savers.

The banks will not continue to pay high interest on savings when the interest rate has been cut. These rates will be reduced also. Something not generally mentioned in the media but the banks do issue paid ads announcing the changes not long after the rate cut.

Along with general inflation this means the annual interest rate will remain below 5 or 6 percent a year. When you consider that gold appreciates in value by around 20 percent per year this certainly makes gold a much better 'investment' than cash in the bank.

In addition, interest accumulated at the bank attre3acts tax at the highest rate for the individual. This can be literally half the gains made from the interest on savings. Gold, on the other hand, does not attract any interest and so does not attract any tax. Ones asset is safe, both when one buys gold and even when one sells gold.

So to buy gold in Australia is now a much more attractive proposition than buying cash. Of course the banks won’t tell you that. Hardly in their interest, no pun intended.

Tuesday, December 06, 2011

Gold the Reserve Currency

Could gold be the reserve currency of the day?

According to Eric Sprott, CEO of Sprott Asset Management, gold has unwittingly been made the reserve currency of the central banks.

In a recent interview Sprott stated, "I don't care whether the central banks have or governments have, but the markets made it the reserve currency... central banks have been aiding and abetting that process - they're almost making it the reserve currency by their actions, not by their statements and when it was a reserve currency silver traded at a ratio of 15 to 16:1 of the price of gold."

Over the shorter term, he says there is clear evidence of strong demand for the metal, "demand for silver is versus the demand for gold in the investment arena and when I see people like Gold Money sell as many dollars of silver, as gold. When I see the US Mint sell as many dollars of silver as gold which by the way implies in both instances, 50 times more physical than gold. And when we did the IPO for Gold Trust we made $440 million. When we did the IPO for the Silver Trust we made $550 million...Well how can the price be 50:1 when the money is going in 1:1?"

In the face of the potential global financial meltdown central banks are buying up gold as a hedge against currency losses, supporting the argument that gold is money.

Countries are also buying up gold and holding it in reserve. Russia, China, India are the biggest but also smaller countries such as Korea for example, are accumulating gold by the ton.

India is also not the only country where individuals accumulate and store gold, China is encouraging its citizens to do the same. Interesting that the western powers are encouraging people to buy currency, not gold.

This says more about the countries governmental policies than it does about gold as money.

The Maxim to follow? Buy gold, not money!

According to Eric Sprott, CEO of Sprott Asset Management, gold has unwittingly been made the reserve currency of the central banks.

In a recent interview Sprott stated, "I don't care whether the central banks have or governments have, but the markets made it the reserve currency... central banks have been aiding and abetting that process - they're almost making it the reserve currency by their actions, not by their statements and when it was a reserve currency silver traded at a ratio of 15 to 16:1 of the price of gold."

Over the shorter term, he says there is clear evidence of strong demand for the metal, "demand for silver is versus the demand for gold in the investment arena and when I see people like Gold Money sell as many dollars of silver, as gold. When I see the US Mint sell as many dollars of silver as gold which by the way implies in both instances, 50 times more physical than gold. And when we did the IPO for Gold Trust we made $440 million. When we did the IPO for the Silver Trust we made $550 million...Well how can the price be 50:1 when the money is going in 1:1?"

In the face of the potential global financial meltdown central banks are buying up gold as a hedge against currency losses, supporting the argument that gold is money.

Countries are also buying up gold and holding it in reserve. Russia, China, India are the biggest but also smaller countries such as Korea for example, are accumulating gold by the ton.

India is also not the only country where individuals accumulate and store gold, China is encouraging its citizens to do the same. Interesting that the western powers are encouraging people to buy currency, not gold.

This says more about the countries governmental policies than it does about gold as money.

The Maxim to follow? Buy gold, not money!

Monday, December 05, 2011

You can print money but you can’t print gold.

Which is probably the reason why the banking fraternity regard gold as a rebellious cousin to be tolerated out the back, but not shown to the public.

Unfortunately printing money does not increase the value of money quite the contrary, but it does improve the price of gold. A good excuse to buy gold incidently.

Some banks still instinctively understand the value of gold as evidenced by their continued buying of the precious metal. According to the World Gold Council central banks have been accelerating their gold purchases over the past few months. Are they shoring up their assets in preparation for an expected fall? Can they see something on the horizon that we can't?

The Bank of Korea for example. Which bought 25 tone of gold in June and July this year followed that up with regular purchases including 15 tones in November. "We bought the gold as part of our diversification strategy and based on long-term investment considerations," Lee Jung, an official at the bank's reserve management group, told reporters.

The bank said recently they bought gold in November for the second time this year, 'to diversify its foreign reserves, joining its counterparts in other countries in seeking protection against financial instability and inflation.'

According to Arne Lohmann Rasmussen, the head of rates, foreign-exchange and commodity strategy at Danske Bank A/S, "South Korea has huge reserves. When they are buying gold, it’s supportive for the market."

So with the instability in the financial markets caused by excessive debt, even the central banks will turn to the only stable of gold bullion to protect its interests.

"Emerging economies including Russia and China have been adding their gold reserves, as the situation in the United States and Europe is not looking great," said Hou Xinqiang, an analyst at Jinrui Futures in China.

"Growing appetite for gold from central banks will surely support gold prices to further rally in the next few years, and gold is gaining an increasingly prominent status on central banks' books."

"While the bulk of central bank gold is still held in North America and Europe, a build-up of gold reserves in emerging markets has been a consistent feature over the last few years," said the council in a research report published recently.

But China’s gold accumulation is moving forward in leaps and bounds. Gold purchases in Sept hit an all time high of 56.9 tones. In the July to Sept quarter over 140 tones of gold bullion was bought by China.

China has been encouraging its citizens to buy and hold physical gold and has widened the number of banks allowed to import gold. It has been encouraging its citizens to buy gold and the encouragement of gold investment has been emphasised with gold exchanges now opening around China with the first opened on Jun 28th this year. In fact China's demand for gold has increased 25 percent, much more than the usual global average of seven percent.

And China's Middle Class is growing by the day buying more and more gold. With 320 million Chinese introduced in to the gold market, the gold purchases in the western world will pale into insignificance.

What will that do to the gold price I wonder?

Indeed, is China going to be the first country to adopt a gold standard? It seems quite possible that the new gold standard may be 'hosted' not by the US or Europe (even Switzerland has bailed out) but by Asia with its determination to reduce its exposure to foreign debt. Converting this debt into gold is a sound practice.

Gold is the only money around. All else is simply paper, Asia knows this, the banks know this. Astute gold bugs know this. Even some parts of the mainstream media are starting to wake up. And the more people do, the more demand is going to be placed for gold and the higher the value is going to be placed on gold as real money. The rise is going to be exponential and soon only the central banks, institutions and the very wealthy will be able to afford a simple ounce of gold. That is, if China does not have it all.

The gold standard is not far away now. Time to buy gold. Afterall, you can print money but you can't print gold.

Unfortunately printing money does not increase the value of money quite the contrary, but it does improve the price of gold. A good excuse to buy gold incidently.

Some banks still instinctively understand the value of gold as evidenced by their continued buying of the precious metal. According to the World Gold Council central banks have been accelerating their gold purchases over the past few months. Are they shoring up their assets in preparation for an expected fall? Can they see something on the horizon that we can't?

The Bank of Korea for example. Which bought 25 tone of gold in June and July this year followed that up with regular purchases including 15 tones in November. "We bought the gold as part of our diversification strategy and based on long-term investment considerations," Lee Jung, an official at the bank's reserve management group, told reporters.

The bank said recently they bought gold in November for the second time this year, 'to diversify its foreign reserves, joining its counterparts in other countries in seeking protection against financial instability and inflation.'

According to Arne Lohmann Rasmussen, the head of rates, foreign-exchange and commodity strategy at Danske Bank A/S, "South Korea has huge reserves. When they are buying gold, it’s supportive for the market."

So with the instability in the financial markets caused by excessive debt, even the central banks will turn to the only stable of gold bullion to protect its interests.

"Emerging economies including Russia and China have been adding their gold reserves, as the situation in the United States and Europe is not looking great," said Hou Xinqiang, an analyst at Jinrui Futures in China.

"Growing appetite for gold from central banks will surely support gold prices to further rally in the next few years, and gold is gaining an increasingly prominent status on central banks' books."

"While the bulk of central bank gold is still held in North America and Europe, a build-up of gold reserves in emerging markets has been a consistent feature over the last few years," said the council in a research report published recently.

But China’s gold accumulation is moving forward in leaps and bounds. Gold purchases in Sept hit an all time high of 56.9 tones. In the July to Sept quarter over 140 tones of gold bullion was bought by China.

China has been encouraging its citizens to buy and hold physical gold and has widened the number of banks allowed to import gold. It has been encouraging its citizens to buy gold and the encouragement of gold investment has been emphasised with gold exchanges now opening around China with the first opened on Jun 28th this year. In fact China's demand for gold has increased 25 percent, much more than the usual global average of seven percent.

And China's Middle Class is growing by the day buying more and more gold. With 320 million Chinese introduced in to the gold market, the gold purchases in the western world will pale into insignificance.

What will that do to the gold price I wonder?

Indeed, is China going to be the first country to adopt a gold standard? It seems quite possible that the new gold standard may be 'hosted' not by the US or Europe (even Switzerland has bailed out) but by Asia with its determination to reduce its exposure to foreign debt. Converting this debt into gold is a sound practice.

Gold is the only money around. All else is simply paper, Asia knows this, the banks know this. Astute gold bugs know this. Even some parts of the mainstream media are starting to wake up. And the more people do, the more demand is going to be placed for gold and the higher the value is going to be placed on gold as real money. The rise is going to be exponential and soon only the central banks, institutions and the very wealthy will be able to afford a simple ounce of gold. That is, if China does not have it all.

The gold standard is not far away now. Time to buy gold. Afterall, you can print money but you can't print gold.

Tuesday, November 29, 2011

The World is Buying Gold

Russia, one of the biggest holders of gold bullion is buying gold hand over fist. It has recently increased its gold bullion reserves by a massive 19.5 tons last month according to the International Monetary Fund (IMF).

In fact a whopping 25.7 tons of gold with a value of 1.38 billion dollars have just been added to existing reserves in Belarus, Colombia, Kazakhstan, Mexico and Russia.

Kazakhstan increased its gold assets by 3.2 tons to 73.6 tons. Colombia went up 1.2 tons to total 10.4 tons, Belarus bought 1 ton to make 31.9 tons and Mexico expanded its assets by 0.9 ton to make their holdings 106.3 tons. All buying gold.

Bloomberg is also reporting that central banks are expanding their reserves of gold.

Information from the IMF indicates central banks and government institutions bought 142 tons last year while it is predicted that this year may mark purchases of ten times that according to Marcus Grubb, managing director of investment research at the London- based World Gold Council.

"Given gold's much more attractive levels in October, we would not be surprised if a similar trend of significantly more buying than is reflected by IMF data actually occurred during the month," UBS AG analyst in London, Edel Tully said.

Just recently, the president of Venezuela, Hugo Chavez, took delivery of the first batch of gold bullion. 160 tons from the Bank of England.

"We are bringing the gold back because unfortunately capital markets and the world economy are in turmoil, and for that reason it is preferable to seek protection," said Nelson Merentes, president of the Venezuelan central bank.

More than 80 percent of Venezuela's 211 tons of gold reserves are in the United Kingdom, mainly in the Bank of England and are valued at $11 billion.

The remaining 152 tons of its gold reserves, valued at $7.2 billion, are already in Venezuela's central bank vaults.

According to the Financial Times, Venezuela has the 15th largest gold reserves in the world. With more than 60 percent of its international reserves in gold, nearly eight times the regional average.

And China continues its goal of steadily building up its gold reserves including actively encouraging its citizens to buy gold.

Methinks a boom in the gold price is expected soon so now is the time to buy gold.

In fact a whopping 25.7 tons of gold with a value of 1.38 billion dollars have just been added to existing reserves in Belarus, Colombia, Kazakhstan, Mexico and Russia.

Kazakhstan increased its gold assets by 3.2 tons to 73.6 tons. Colombia went up 1.2 tons to total 10.4 tons, Belarus bought 1 ton to make 31.9 tons and Mexico expanded its assets by 0.9 ton to make their holdings 106.3 tons. All buying gold.

Bloomberg is also reporting that central banks are expanding their reserves of gold.

Information from the IMF indicates central banks and government institutions bought 142 tons last year while it is predicted that this year may mark purchases of ten times that according to Marcus Grubb, managing director of investment research at the London- based World Gold Council.

"Given gold's much more attractive levels in October, we would not be surprised if a similar trend of significantly more buying than is reflected by IMF data actually occurred during the month," UBS AG analyst in London, Edel Tully said.

Just recently, the president of Venezuela, Hugo Chavez, took delivery of the first batch of gold bullion. 160 tons from the Bank of England.

"We are bringing the gold back because unfortunately capital markets and the world economy are in turmoil, and for that reason it is preferable to seek protection," said Nelson Merentes, president of the Venezuelan central bank.

More than 80 percent of Venezuela's 211 tons of gold reserves are in the United Kingdom, mainly in the Bank of England and are valued at $11 billion.

The remaining 152 tons of its gold reserves, valued at $7.2 billion, are already in Venezuela's central bank vaults.

According to the Financial Times, Venezuela has the 15th largest gold reserves in the world. With more than 60 percent of its international reserves in gold, nearly eight times the regional average.

And China continues its goal of steadily building up its gold reserves including actively encouraging its citizens to buy gold.

Methinks a boom in the gold price is expected soon so now is the time to buy gold.

Friday, November 25, 2011

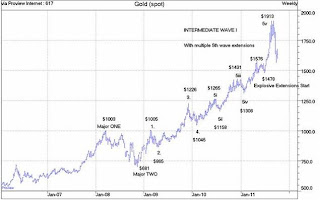

Elliott Wave Gold Price Predictions

What is the future gold price? The gold price you see in the news media is not actually the price of gold. It is considered to be the ‘gold futures ‘price, but it is not even the future price of gold since no one can predict with absolute certainty what the future price of gold is going to be. The future gold price is what the price of gold will be at some time in the future. Not something easily predicted with the amount of factors and variables that can affect the price.

On what does the gold price depend? Well it does not depend on the value of gold as that is remarkably unchanged over the years. The value of gold as seen through what you can exchange it for has remained relatively the same for hundreds of years. Of course there are fluctuations and slight variations from time to time, but essentially the value of gold has not changed.

The price of gold is dependent more upon the value of the currency by which the price of gold measured. When the perceived value of the currency rises or falls, the price of gold is affected and is reflected in that price. This does not affect the value of the gold, only the quantity of currency needed to purchase it or for which it can be sold. Important to note when it comes to buying gold.

Not withstanding the above, there are attempts, naturally enough, to predict the price of gold and one of these methods is by the use of the Elliott Wave Theory. The Elliott Wave Theory is a way or method of predicting, or forecasting, the trends of financial market cycles by pinpointing extremes in investor psychology along with various other factors.

According to Wikipedia: 'Ralph Nelson Elliott (1871–1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call Elliott waves, or simply waves. Elliott published his theory of market behavior in the book The Wave Principle in 1938'

This theory has been applied to the price of gold with some interesting results.

At the recent Gold Symposium in Sydney, Alf Field, a noted gold expert stated in a 6500 word keynote speech, "The Elliott Wave Theory (EW) gives superb results in predicting the gold price. [While] it is a complicated system with many difficult rules [which] I explain in simple terms in this article, [I have determined that] once this present correction in gold has been completed it should [undergo] the largest and strongest wave in the entire gold bull market. The target for this wave should be around $4,500 with only two 13% corrections on the way."

His almost an hour explanation of this included a number of charts showing how the gold has moved over the past 40 years and that it follows the Elliott Wave Theory almost exactly.

This is a prediction, based on past activity and assumes that the trends and activity will continue. Other prediction methods include taking into account the existing economic trends and activities, changing perceptions of gold in this uncertain economic climate and the value of gold based on supply and demand.

Regardless of the method used or the study and analysis undertaken it seems evident that, as the value of currency deteriorates, the gold price will continue its upward movement requiring more currency to buy gold than it ever did.

This means that now is a good time to buy gold if one wants to retain and preserve one's assets in these uncertain economic times.

On what does the gold price depend? Well it does not depend on the value of gold as that is remarkably unchanged over the years. The value of gold as seen through what you can exchange it for has remained relatively the same for hundreds of years. Of course there are fluctuations and slight variations from time to time, but essentially the value of gold has not changed.

The price of gold is dependent more upon the value of the currency by which the price of gold measured. When the perceived value of the currency rises or falls, the price of gold is affected and is reflected in that price. This does not affect the value of the gold, only the quantity of currency needed to purchase it or for which it can be sold. Important to note when it comes to buying gold.

Not withstanding the above, there are attempts, naturally enough, to predict the price of gold and one of these methods is by the use of the Elliott Wave Theory. The Elliott Wave Theory is a way or method of predicting, or forecasting, the trends of financial market cycles by pinpointing extremes in investor psychology along with various other factors.

According to Wikipedia: 'Ralph Nelson Elliott (1871–1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call Elliott waves, or simply waves. Elliott published his theory of market behavior in the book The Wave Principle in 1938'

This theory has been applied to the price of gold with some interesting results.

At the recent Gold Symposium in Sydney, Alf Field, a noted gold expert stated in a 6500 word keynote speech, "The Elliott Wave Theory (EW) gives superb results in predicting the gold price. [While] it is a complicated system with many difficult rules [which] I explain in simple terms in this article, [I have determined that] once this present correction in gold has been completed it should [undergo] the largest and strongest wave in the entire gold bull market. The target for this wave should be around $4,500 with only two 13% corrections on the way."

His almost an hour explanation of this included a number of charts showing how the gold has moved over the past 40 years and that it follows the Elliott Wave Theory almost exactly.

This is a prediction, based on past activity and assumes that the trends and activity will continue. Other prediction methods include taking into account the existing economic trends and activities, changing perceptions of gold in this uncertain economic climate and the value of gold based on supply and demand.

Regardless of the method used or the study and analysis undertaken it seems evident that, as the value of currency deteriorates, the gold price will continue its upward movement requiring more currency to buy gold than it ever did.

This means that now is a good time to buy gold if one wants to retain and preserve one's assets in these uncertain economic times.

Tuesday, November 22, 2011

Is China cornering the gold market?

Is China out to corner the gold market?

China is currently buying gold as fast as the west can sell it. This appears to be a long term strategy to preserve its wealth in the face oif currency deterioration in the west, primarily in Europe and the US. China carries massive debt from the west and is evidently looking to convert this debt to asset value as the value of debt deteriorates.

The Chinese government is now encouraging its citizens to invest in gold as well as itself buying up all the gold it can get its hands on.

According to Paul Mylchreest's Thunder Road Report, China is pushing the idea of buying gold and silver for investment purposes to its citizens virtually in the same way that Western media sells soap powder and comments that, "If 1.3 billion Chinese citizens start buying gold and silver, even in tiny quantities, imagine what that will do to the market!"

The report also notes China's Central Television, has been running a news program actively encouraging its citizens to buy gold and showing how easy it is to buy gold as an investment. Even on silver investment the news announcer is quoted as saying, " China has introduced its first ever investment opportunity for silver bullion. The bars are available in 500g, 1kg, 2kg and 5kg with a purity of 99.9%. Figures show that gold was fifty times more expensive than silver in 2007, but now that figure has reached over seventy times.

Analysts say that silver has been undervalued in recent years. They add that the metal is the right investment for individual investors and could be a good way to cash in."

Paul ends the piece on Chinese gold and silver potential with the following quote from Christine Verone, the first (and only) foreigner in the country to become a certified "expert" on the Chinese gold markets, a designation awarded exclusively by the Shanghai Gold Exchange...and also the first foreigner in history to ever be licensed in any professional capacity by a Chinese commodity exchange.

"Simply put, the Chinese government is trying to trigger a national gold craze...and its working. The Chinese public now has gold trading platforms on steroids.... ...Also, for the first time in history, Chinese investors can even trade gold abroad (in London) with the swipe of a 'Lucky Gold' card. I can't even get Bank of America to open a foreign currency account."

The existing LMBA and New York gold markets will also pale into insignificance if the Chinese gold market takes off. With the Chinese population now surpassing 1,338,299,000 the potential for the gold price to rise to astronomical heights is becoming more real each day.

Especially with the recently opened Pan Asian Gold Exchange (PAGE) enabling buyers to bypass the bullion banks and the LBMA as well as open the door for the international investor to buy renminbi. The financialsense.com website recently pointed out, "PAGE also provides a new way for international investors to own Chinese currency - the Renminbi (RMB). Here's how: The buyers will purchase gold contracts denominated in RMB. They can then hedge out the gold in the dollar-based gold markets. As a result, they effectively own RMB.

"We see here yet another example of multiple Beijing initiatives opening the RMB to world investors. Over time, these innovations will enhance the value of the RMB and create a deeper, more liquid foreign exchange presence for the Chinese currency. PAGE is another internationalization step forward for the RMB in the direction of world reserve currency status.

"The advantages of being the world reserve currency, as well as the responsibilities involved, have not been lost in the Chinese government."

If China is indeed actively working on cornering the gold market, perhaps now is a good time to buy gold while it is still cheap and available.

China is currently buying gold as fast as the west can sell it. This appears to be a long term strategy to preserve its wealth in the face oif currency deterioration in the west, primarily in Europe and the US. China carries massive debt from the west and is evidently looking to convert this debt to asset value as the value of debt deteriorates.

The Chinese government is now encouraging its citizens to invest in gold as well as itself buying up all the gold it can get its hands on.

According to Paul Mylchreest's Thunder Road Report, China is pushing the idea of buying gold and silver for investment purposes to its citizens virtually in the same way that Western media sells soap powder and comments that, "If 1.3 billion Chinese citizens start buying gold and silver, even in tiny quantities, imagine what that will do to the market!"

The report also notes China's Central Television, has been running a news program actively encouraging its citizens to buy gold and showing how easy it is to buy gold as an investment. Even on silver investment the news announcer is quoted as saying, " China has introduced its first ever investment opportunity for silver bullion. The bars are available in 500g, 1kg, 2kg and 5kg with a purity of 99.9%. Figures show that gold was fifty times more expensive than silver in 2007, but now that figure has reached over seventy times.

Analysts say that silver has been undervalued in recent years. They add that the metal is the right investment for individual investors and could be a good way to cash in."

Paul ends the piece on Chinese gold and silver potential with the following quote from Christine Verone, the first (and only) foreigner in the country to become a certified "expert" on the Chinese gold markets, a designation awarded exclusively by the Shanghai Gold Exchange...and also the first foreigner in history to ever be licensed in any professional capacity by a Chinese commodity exchange.

"Simply put, the Chinese government is trying to trigger a national gold craze...and its working. The Chinese public now has gold trading platforms on steroids.... ...Also, for the first time in history, Chinese investors can even trade gold abroad (in London) with the swipe of a 'Lucky Gold' card. I can't even get Bank of America to open a foreign currency account."

The existing LMBA and New York gold markets will also pale into insignificance if the Chinese gold market takes off. With the Chinese population now surpassing 1,338,299,000 the potential for the gold price to rise to astronomical heights is becoming more real each day.

Especially with the recently opened Pan Asian Gold Exchange (PAGE) enabling buyers to bypass the bullion banks and the LBMA as well as open the door for the international investor to buy renminbi. The financialsense.com website recently pointed out, "PAGE also provides a new way for international investors to own Chinese currency - the Renminbi (RMB). Here's how: The buyers will purchase gold contracts denominated in RMB. They can then hedge out the gold in the dollar-based gold markets. As a result, they effectively own RMB.

"We see here yet another example of multiple Beijing initiatives opening the RMB to world investors. Over time, these innovations will enhance the value of the RMB and create a deeper, more liquid foreign exchange presence for the Chinese currency. PAGE is another internationalization step forward for the RMB in the direction of world reserve currency status.

"The advantages of being the world reserve currency, as well as the responsibilities involved, have not been lost in the Chinese government."

If China is indeed actively working on cornering the gold market, perhaps now is a good time to buy gold while it is still cheap and available.

Saturday, November 19, 2011

Fake Gold Coins Flood the Markets

Fake gold and silver coins are flooding the market, mostly from China.

With precious metals prices poised to be the biggest price explosion in centuries, fake gold and silver products are becoming a booming industry say Global Piracy & Counterfeiting Consultants (GP&CC).

According to GP&CC, "One Chinese counterfeiter openly bragged about producing 100,000 fake U.S. Silver Dollars per year, and that’s just one counterfeiter. There are many others jumping on the band wagon.

Some of the Chinese counterfeit coins are of very high quality, making it difficult for even some experts to tell the difference. And worse, the U.S. Federal Government is a no show-once again."

Most fake coins can be detected by their weight which will be different to the genuine article. In addition the milled edges on fakes are slanted and not vertical.

Also deal with multiple established dealers who have been around for many years.

When you buy from one dealer, get your gold and silver coins appraised by another independent appraiser. If you’ve invested $10000.00 into precious metals, the additional 100 or so cost to have your investment appraised is a small price to pay to verify the authenticity of your coins.. If you were sold a fake, you can then take immediate action against the offending dealer. It is illegal to sell fake gold and silver coins in the US and in most other western countries so most dealers will make a point of ensuring their coins are genuine.

Knowing the dimensions, weight and exactly how your gold and silver coins should look is important also. Doing your own due diligence is a must.

Despite fake gold and silver coins flooding the market you can still take steps to protect yourself. Don’t let the fact that counterfeits are out there dissuade you from making a good investment decision. Buying gold is still an excellent way to preserve asset value.

With precious metals prices poised to be the biggest price explosion in centuries, fake gold and silver products are becoming a booming industry say Global Piracy & Counterfeiting Consultants (GP&CC).

According to GP&CC, "One Chinese counterfeiter openly bragged about producing 100,000 fake U.S. Silver Dollars per year, and that’s just one counterfeiter. There are many others jumping on the band wagon.

Some of the Chinese counterfeit coins are of very high quality, making it difficult for even some experts to tell the difference. And worse, the U.S. Federal Government is a no show-once again."

Most fake coins can be detected by their weight which will be different to the genuine article. In addition the milled edges on fakes are slanted and not vertical.

Also deal with multiple established dealers who have been around for many years.

When you buy from one dealer, get your gold and silver coins appraised by another independent appraiser. If you’ve invested $10000.00 into precious metals, the additional 100 or so cost to have your investment appraised is a small price to pay to verify the authenticity of your coins.. If you were sold a fake, you can then take immediate action against the offending dealer. It is illegal to sell fake gold and silver coins in the US and in most other western countries so most dealers will make a point of ensuring their coins are genuine.

Knowing the dimensions, weight and exactly how your gold and silver coins should look is important also. Doing your own due diligence is a must.

Despite fake gold and silver coins flooding the market you can still take steps to protect yourself. Don’t let the fact that counterfeits are out there dissuade you from making a good investment decision. Buying gold is still an excellent way to preserve asset value.

Thursday, November 03, 2011

A seven million dollar gold iPad

Luxury goods specialist Stuart Hughes has created the Gold History Edition iPad 2. It weighs two and a half kilos, nearly five times that of an ordinary iPad and at $7,708,000 is one of the most expensive gadgets around.

According to Stuart Hughes, This is a solid gold and diamond iPad. 'Encrusted with 25.5 carats of 'IF' Flawless diamonds, a magnificent total of 53 individually set sparkling gems dwell beautifully in their solid 22ct Apple logo. The rear and screen surround are made from a single piece of solid 22ct gold, weighing an immense 2,100 grams. This most luxurious iPad appearance is outstanding even down to the precise polishing to reveal its most beautiful harmonious appearance. A magnificent combination of top of the industry technology and unrivalled craftsmanship was involved in creating this masterpiece.'

The frame work is made from a 75 million year old stone called Ammolite which has a 65 million year old portion of Tyrannosaurus Rex thigh bone shaved into it.

The iPad used is the Wi-Fi & 3G, 64GB version. This item is a limited edition of only 10 units to be made, but only two have been manufactured so far, with one sold to an anonymous buyer already.

One wit mentioned that once iPad 3 is issued, it will be out of date.

Other devices customised by Hughes include a gold and diamond-encrusted Nintendo Wii worth $460,000 and an iPhone 4 valued at over $7,000,000.

According to Stuart Hughes, This is a solid gold and diamond iPad. 'Encrusted with 25.5 carats of 'IF' Flawless diamonds, a magnificent total of 53 individually set sparkling gems dwell beautifully in their solid 22ct Apple logo. The rear and screen surround are made from a single piece of solid 22ct gold, weighing an immense 2,100 grams. This most luxurious iPad appearance is outstanding even down to the precise polishing to reveal its most beautiful harmonious appearance. A magnificent combination of top of the industry technology and unrivalled craftsmanship was involved in creating this masterpiece.'

The frame work is made from a 75 million year old stone called Ammolite which has a 65 million year old portion of Tyrannosaurus Rex thigh bone shaved into it.

The iPad used is the Wi-Fi & 3G, 64GB version. This item is a limited edition of only 10 units to be made, but only two have been manufactured so far, with one sold to an anonymous buyer already.

One wit mentioned that once iPad 3 is issued, it will be out of date.

Other devices customised by Hughes include a gold and diamond-encrusted Nintendo Wii worth $460,000 and an iPhone 4 valued at over $7,000,000.

Tuesday, November 01, 2011

Real Gold Spun Ties

The result of ten years of work with EMPA Technology has resulted in clothes now made out of high tech gold material rather like the finest of silk yet made of gold.

In this technology gold is sprayed onto polyester in a plasma coating plant. About the size of a normal refrigerator, inside a small piece of gold is sprayed with fast moving argon ions resulting in atoms of gold being knocked off the gold piece and landing on polyester fibre being slowly pulled through the machine. Once the atoms of gold adhere to the surface of the polyester they cannot be removed and so the polyester is suitable for weaving into ties, handkerchiefs and what ever else takes your fancy.

Currently just enough material has been manufactured for three ties and a dozen more available by Christmas 2011. "The first, worldwide exclusive series, tailored in the Zürich tie manufactory Hofmann und Co AG will be on offer to gentlemen with an exclusive sense of style at Swiss francs 7500 apiece." A Christmas present that is very unlikely to be refused.

How much gold is in a gold tie you might ask? According to the textile specialists, a textile panel large enough to make three ties is coated with 25 grams of pure, 24 carat gold. Each tie therefore glows with 8 grams of gold. However it is a very slow process with only enough material being made each year to manufacture less than 600 panels. A lot of the material is also reserved for various project partners such as the Jakob Schlaepfer Company, embroiderers and manufacturers of decorative textiles, who will use the gold yarn for items in its Winter 2012/13 Haute Couture collection.

These gold spun ties are possibly the most expensive gold in the world.

In this technology gold is sprayed onto polyester in a plasma coating plant. About the size of a normal refrigerator, inside a small piece of gold is sprayed with fast moving argon ions resulting in atoms of gold being knocked off the gold piece and landing on polyester fibre being slowly pulled through the machine. Once the atoms of gold adhere to the surface of the polyester they cannot be removed and so the polyester is suitable for weaving into ties, handkerchiefs and what ever else takes your fancy.

Currently just enough material has been manufactured for three ties and a dozen more available by Christmas 2011. "The first, worldwide exclusive series, tailored in the Zürich tie manufactory Hofmann und Co AG will be on offer to gentlemen with an exclusive sense of style at Swiss francs 7500 apiece." A Christmas present that is very unlikely to be refused.

How much gold is in a gold tie you might ask? According to the textile specialists, a textile panel large enough to make three ties is coated with 25 grams of pure, 24 carat gold. Each tie therefore glows with 8 grams of gold. However it is a very slow process with only enough material being made each year to manufacture less than 600 panels. A lot of the material is also reserved for various project partners such as the Jakob Schlaepfer Company, embroiderers and manufacturers of decorative textiles, who will use the gold yarn for items in its Winter 2012/13 Haute Couture collection.

These gold spun ties are possibly the most expensive gold in the world.

Royal Canadian Mint's New Gold ETRs Program

The Royal Mint is introducing a new gold ETR program of Exchange Traded Receipts (ETRs) under the Mint's new Canadian Gold Reserves program. According to the Mint, 'Each ETR provides evidence of ownership in physical gold bullion held in the custody of the Mint at its facilities in Ottawa, Ontario. The Canadian Gold Reserves program marks the expansion of the Mint's successful core bullion and refinery business.'

"We believe that this new program will build on our reputation and continued success as a world-class custodian of precious metals," said Ian E. Bennett, President and CEO of the Royal Canadian Mint. "With the introduction of the Canadian Gold Reserves ETR program we hope that investors will see this as a convenient, efficient and secure method for investing in and owning physical gold."

Unlike gold ETFs and some other gold investment products the owner of the gold ETR actually owns the gold and not just a share in an entity that owns the gold.

The Issue price will be 20 Canadian Dollars and the amount of gold for that will be determined at the closing date which will be in late November. This will be a prospectus exempt issue and, subject to the usual conditions will be listed on the Toronto Stock Exchange with trade commencing on the closing day of the offer.

Unlike Gold ETFs, ETR holders will be entitled to redeem their ETRs if required in the form of 99.99 percent pure gold bars, coins or cash all of which will be based on the future gold price or market price of the ETRs at the time of redemption or sale.

ETRs will not be available for sale in the USA, this is a Canadian initiative only and will be available only through investment dealers led by TD Securities Inc. and National Bank Financial Inc., and including BMO Nesbitt Burns Inc., CIBC World Markets Inc., RBC Dominion Securities Inc., Canaccord Genuity Corp., Cormark Securities Inc., MGI Securities Inc. and Raymond James Ltd. to distribute the ETRs on a best efforts agency basis.

For Canadians the Royal Canadian Mint's New Gold ETRs Program could be a good way to buy gold.

"We believe that this new program will build on our reputation and continued success as a world-class custodian of precious metals," said Ian E. Bennett, President and CEO of the Royal Canadian Mint. "With the introduction of the Canadian Gold Reserves ETR program we hope that investors will see this as a convenient, efficient and secure method for investing in and owning physical gold."

Unlike gold ETFs and some other gold investment products the owner of the gold ETR actually owns the gold and not just a share in an entity that owns the gold.

The Issue price will be 20 Canadian Dollars and the amount of gold for that will be determined at the closing date which will be in late November. This will be a prospectus exempt issue and, subject to the usual conditions will be listed on the Toronto Stock Exchange with trade commencing on the closing day of the offer.

Unlike Gold ETFs, ETR holders will be entitled to redeem their ETRs if required in the form of 99.99 percent pure gold bars, coins or cash all of which will be based on the future gold price or market price of the ETRs at the time of redemption or sale.

ETRs will not be available for sale in the USA, this is a Canadian initiative only and will be available only through investment dealers led by TD Securities Inc. and National Bank Financial Inc., and including BMO Nesbitt Burns Inc., CIBC World Markets Inc., RBC Dominion Securities Inc., Canaccord Genuity Corp., Cormark Securities Inc., MGI Securities Inc. and Raymond James Ltd. to distribute the ETRs on a best efforts agency basis.

For Canadians the Royal Canadian Mint's New Gold ETRs Program could be a good way to buy gold.

Thursday, October 27, 2011

The One Tonne Gold Coin

The Perth mint (Australia) has just unveiled the worlds most valuable gold coin.

At a massive one thousand and 12 kilograms, the 99.99 per cent pure gold coin weights over a tonne and there is very little small change out of the 54 million dollars you would have to pay for it.

This gives a new meaning to the cry, buy gold!

Weighing in at one thousand and 12 kilograms, it measures nearly 80 centimetres wide and over 12 centimetres thick. It has Australian legal tender status with a face value of one million dollars. And at one tonne (1,000kg), it's the biggest, heaviest, inherently most valuable gold bullion coin in the world.

It's worth just under 54 million dollars and features a bounding red kangaroo on one side, and the Queen's motif on the other.

"The giant coin is a magnificent Australian icon symbolising one of the Mint's most extraordinary accomplishments in its 112-year history. "Said Perth mints chief executive Ed Harbuz.

"To cast and handcraft a coin of this size and weight was an incredible challenge - one which few other mints would even consider," he said.

He went on to say the coin was a showpiece of the Australian kangaroo gold bullion coin program. It will coincide with the release of a number of smaller gold coins this week, the weight and purity of each being guaranteed by the West Australian government, and these will certainly be within the grasp of anyone wanting to buy gold coins.

At a massive one thousand and 12 kilograms, the 99.99 per cent pure gold coin weights over a tonne and there is very little small change out of the 54 million dollars you would have to pay for it.

This gives a new meaning to the cry, buy gold!

Weighing in at one thousand and 12 kilograms, it measures nearly 80 centimetres wide and over 12 centimetres thick. It has Australian legal tender status with a face value of one million dollars. And at one tonne (1,000kg), it's the biggest, heaviest, inherently most valuable gold bullion coin in the world.

It's worth just under 54 million dollars and features a bounding red kangaroo on one side, and the Queen's motif on the other.

"The giant coin is a magnificent Australian icon symbolising one of the Mint's most extraordinary accomplishments in its 112-year history. "Said Perth mints chief executive Ed Harbuz.

"To cast and handcraft a coin of this size and weight was an incredible challenge - one which few other mints would even consider," he said.

He went on to say the coin was a showpiece of the Australian kangaroo gold bullion coin program. It will coincide with the release of a number of smaller gold coins this week, the weight and purity of each being guaranteed by the West Australian government, and these will certainly be within the grasp of anyone wanting to buy gold coins.

Tuesday, October 25, 2011

GOLD ATM dispenser in India

Mumbai has become the first city to have a gold ATM dispenser in India. Not only that but it rolls out silver and Diamonds also. The ATM gives new meaning to the term buy gold in India.

The Gitanjali Group, opened the machine in a luxury shopping mall in the city recently and stated it had already served a "substantial number of customers". The Gitanjali Group is a modern integrated conglomerate, producing a diverse range of jewellery: gold, silver, platinum and stainless steel, studded with diamond and other gems.

It expects to roll out 75 more of the gold, silver and diamond dispensers in shopping malls, airports and even at Hindu temples.

The Gitanjali Group Chief Sanjeev Agarwal said: “The machine is a first of its kind anywhere in the world and will further revolutionise the processes by which precious metals and jewellery is bought.

"It has a particular significance in India, where usually such items are purchased as tokens to observe traditions on auspicious days."

"But it also offers choices for occasions like Valentine's Day, or to a husband who forgot an anniversary or his wife's birthday!"

Prices range from 1000 rupees ($20) to 30,000 rupees and customers can pay by cash or credit card for products ranging from gold coins etched with an image of Lakshmi, the Hindu goddess of wealth, to diamond-studded pendants in the shape of a swastika, in India a ancient religious symbol of unity.

Jammy Gagrat, a 47-year-old businessman, said: "This machine is going to be a problem for the gents. Ladies are going to keep on buying more and more every time they come here."

Buying gold in India just became easier.

The Gitanjali Group, opened the machine in a luxury shopping mall in the city recently and stated it had already served a "substantial number of customers". The Gitanjali Group is a modern integrated conglomerate, producing a diverse range of jewellery: gold, silver, platinum and stainless steel, studded with diamond and other gems.

It expects to roll out 75 more of the gold, silver and diamond dispensers in shopping malls, airports and even at Hindu temples.

The Gitanjali Group Chief Sanjeev Agarwal said: “The machine is a first of its kind anywhere in the world and will further revolutionise the processes by which precious metals and jewellery is bought.

"It has a particular significance in India, where usually such items are purchased as tokens to observe traditions on auspicious days."

"But it also offers choices for occasions like Valentine's Day, or to a husband who forgot an anniversary or his wife's birthday!"

Prices range from 1000 rupees ($20) to 30,000 rupees and customers can pay by cash or credit card for products ranging from gold coins etched with an image of Lakshmi, the Hindu goddess of wealth, to diamond-studded pendants in the shape of a swastika, in India a ancient religious symbol of unity.

Jammy Gagrat, a 47-year-old businessman, said: "This machine is going to be a problem for the gents. Ladies are going to keep on buying more and more every time they come here."

Buying gold in India just became easier.

Sunday, October 16, 2011

Hong Kong trading gold

Hong Kong's Chinese Gold and Silver exchange has officially started trading today. Gold denominated in renminbi can be used by Chinese to trade in and even redeem gold on the exchange.

Haywood Cheung, the president of the 101-year-old bullion exchange, said the so-called Renminbi Kilobar Gold contracts could boost trading volumes by up to 30%, or HK$40 billion a day, during the next six months. Growth has already been strong this year, with average daily electronic transactions reaching HK$136 billion after a full-year average of just HK$31 billion in 2010.

"By attracting both local and international investors, the Renminbi Kilobar Gold is a significant step towards internationalising the renminbi," said Cheung. "It also consolidates Hong Kong's position as an offshore renminbi centre by providing investors with a new alternative in leveraged trading of renminbi."

Cheung told Finance Asia that the ability to leverage by converting renminbi into new gold contracts will be able to gear up their exposure to the currency and put it to work.

Cheung argues that gold is half-way through a 10 to 15-year bull cycle and that renminbi will appreciate by 5% to 6% a year before it becomes freely convertible. A much better proposition than sluggish bank deposit returns.

As Shanghai currently hosts online trading of gold contracts and a new gold exchange is set to start up in China in June next year, this will only increase healthy competition and contribute to a healthy increase in the gold price.

It is reported that Chinese investors have increased their share of trading on the CGSE to 50% to 60%, up from around 30% at the start of the year.

As both exchanges have the same standards of purity it is possible that more cooperation between the exchanges is possible in the future. I. "When they open up, I think we can be very good associates," said Cheung.

According to Finance Asia, "Trading of the Renminbi Kilobar Gold contracts will start with 25 of the exchange's member firms from various sectors, including banking and gold dealing, with Wing Hang Bank and Bank of China acting as settlement banks. The spot gold contracts are traded under the revamped electronic trading system established by the CGSE and quoted and settled in renminbi. Starting from today, members can take physical delivery of the gold upon settlement."

Seems millions more Chinese will be buying gold in the coming months and years.

Haywood Cheung, the president of the 101-year-old bullion exchange, said the so-called Renminbi Kilobar Gold contracts could boost trading volumes by up to 30%, or HK$40 billion a day, during the next six months. Growth has already been strong this year, with average daily electronic transactions reaching HK$136 billion after a full-year average of just HK$31 billion in 2010.

"By attracting both local and international investors, the Renminbi Kilobar Gold is a significant step towards internationalising the renminbi," said Cheung. "It also consolidates Hong Kong's position as an offshore renminbi centre by providing investors with a new alternative in leveraged trading of renminbi."

Cheung told Finance Asia that the ability to leverage by converting renminbi into new gold contracts will be able to gear up their exposure to the currency and put it to work.

Cheung argues that gold is half-way through a 10 to 15-year bull cycle and that renminbi will appreciate by 5% to 6% a year before it becomes freely convertible. A much better proposition than sluggish bank deposit returns.

As Shanghai currently hosts online trading of gold contracts and a new gold exchange is set to start up in China in June next year, this will only increase healthy competition and contribute to a healthy increase in the gold price.

It is reported that Chinese investors have increased their share of trading on the CGSE to 50% to 60%, up from around 30% at the start of the year.

As both exchanges have the same standards of purity it is possible that more cooperation between the exchanges is possible in the future. I. "When they open up, I think we can be very good associates," said Cheung.

According to Finance Asia, "Trading of the Renminbi Kilobar Gold contracts will start with 25 of the exchange's member firms from various sectors, including banking and gold dealing, with Wing Hang Bank and Bank of China acting as settlement banks. The spot gold contracts are traded under the revamped electronic trading system established by the CGSE and quoted and settled in renminbi. Starting from today, members can take physical delivery of the gold upon settlement."

Seems millions more Chinese will be buying gold in the coming months and years.

Reading a Gold Mining Company Prospectus

Reading a gold mining company prospectus can be a little daunting if one does not understand the terms or the importance of various factors relating to gold mining and in order to invest in a gold mining company it is important to understand the prospectus issued by the gold company. It is the main document on which one bases a decision to buy or not buy shares in the company and so should be looked at with care and understanding.

A gold mining company prospectus should be professionally presented and clearly written. It should contain a number of sections including:

A Chairman's Letter

The Details of the Offer

The Capital Structure

Information on the board and management

Usually a director’s view of the project or projects

Exploration budgets and programs

An independent geologist's report

A solicitor's report (or sometimes called an independent review of the tenements)

An independent account's report

Information on the corporate governance

The risk factors listed

A glossary of terms and a corporate directory, as well as the application for shares in the company.

A Chairman's Letter

Usually a welcome and introduction to the prospectus with some information about the prospectus, who the company is and what they are doing and so forth.

The Details of the Offer

This should list how many shares are on offer and what the starting price is. Usually a company is seeking to raise a certain amount of capital and this is the favourite way of do so. By offering shares a company can obtain the capital it requires to fund its projects and the shares holders get a share of the profits obtained thereby.

Usually there is a minimum and a maximum number of shares which can be subscribed to and all the shares are what are called fully paid ordinary shares.

There is also an opening date and closing date for the purchase of shares.