What is the future gold price? The gold price you see in the news media is not actually the price of gold. It is considered to be the ‘gold futures ‘price, but it is not even the future price of gold since no one can predict with absolute certainty what the future price of gold is going to be. The future gold price is what the price of gold will be at some time in the future. Not something easily predicted with the amount of factors and variables that can affect the price.

On what does the gold price depend? Well it does not depend on the value of gold as that is remarkably unchanged over the years. The value of gold as seen through what you can exchange it for has remained relatively the same for hundreds of years. Of course there are fluctuations and slight variations from time to time, but essentially the value of gold has not changed.

The price of gold is dependent more upon the value of the currency by which the price of gold measured. When the perceived value of the currency rises or falls, the price of gold is affected and is reflected in that price. This does not affect the value of the gold, only the quantity of currency needed to purchase it or for which it can be sold. Important to note when it comes to buying gold.

Not withstanding the above, there are attempts, naturally enough, to predict the price of gold and one of these methods is by the use of the Elliott Wave Theory. The Elliott Wave Theory is a way or method of predicting, or forecasting, the trends of financial market cycles by pinpointing extremes in investor psychology along with various other factors.

According to Wikipedia: 'Ralph Nelson Elliott (1871–1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call Elliott waves, or simply waves. Elliott published his theory of market behavior in the book The Wave Principle in 1938'

This theory has been applied to the price of gold with some interesting results.

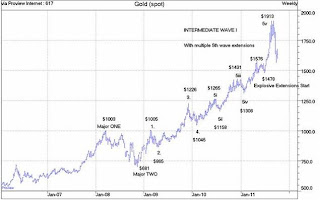

At the recent Gold Symposium in Sydney, Alf Field, a noted gold expert stated in a 6500 word keynote speech, "The Elliott Wave Theory (EW) gives superb results in predicting the gold price. [While] it is a complicated system with many difficult rules [which] I explain in simple terms in this article, [I have determined that] once this present correction in gold has been completed it should [undergo] the largest and strongest wave in the entire gold bull market. The target for this wave should be around $4,500 with only two 13% corrections on the way."

His almost an hour explanation of this included a number of charts showing how the gold has moved over the past 40 years and that it follows the Elliott Wave Theory almost exactly.

This is a prediction, based on past activity and assumes that the trends and activity will continue. Other prediction methods include taking into account the existing economic trends and activities, changing perceptions of gold in this uncertain economic climate and the value of gold based on supply and demand.

Regardless of the method used or the study and analysis undertaken it seems evident that, as the value of currency deteriorates, the gold price will continue its upward movement requiring more currency to buy gold than it ever did.

This means that now is a good time to buy gold if one wants to retain and preserve one's assets in these uncertain economic times.

No comments:

Post a Comment