Russia, one of the biggest holders of gold bullion is buying gold hand over fist. It has recently increased its gold bullion reserves by a massive 19.5 tons last month according to the International Monetary Fund (IMF).

In fact a whopping 25.7 tons of gold with a value of 1.38 billion dollars have just been added to existing reserves in Belarus, Colombia, Kazakhstan, Mexico and Russia.

Kazakhstan increased its gold assets by 3.2 tons to 73.6 tons. Colombia went up 1.2 tons to total 10.4 tons, Belarus bought 1 ton to make 31.9 tons and Mexico expanded its assets by 0.9 ton to make their holdings 106.3 tons. All buying gold.

Bloomberg is also reporting that central banks are expanding their reserves of gold.

Information from the IMF indicates central banks and government institutions bought 142 tons last year while it is predicted that this year may mark purchases of ten times that according to Marcus Grubb, managing director of investment research at the London- based World Gold Council.

"Given gold's much more attractive levels in October, we would not be surprised if a similar trend of significantly more buying than is reflected by IMF data actually occurred during the month," UBS AG analyst in London, Edel Tully said.

Just recently, the president of Venezuela, Hugo Chavez, took delivery of the first batch of gold bullion. 160 tons from the Bank of England.

"We are bringing the gold back because unfortunately capital markets and the world economy are in turmoil, and for that reason it is preferable to seek protection," said Nelson Merentes, president of the Venezuelan central bank.

More than 80 percent of Venezuela's 211 tons of gold reserves are in the United Kingdom, mainly in the Bank of England and are valued at $11 billion.

The remaining 152 tons of its gold reserves, valued at $7.2 billion, are already in Venezuela's central bank vaults.

According to the Financial Times, Venezuela has the 15th largest gold reserves in the world. With more than 60 percent of its international reserves in gold, nearly eight times the regional average.

And China continues its goal of steadily building up its gold reserves including actively encouraging its citizens to buy gold.

Methinks a boom in the gold price is expected soon so now is the time to buy gold.

Tuesday, November 29, 2011

Friday, November 25, 2011

Elliott Wave Gold Price Predictions

What is the future gold price? The gold price you see in the news media is not actually the price of gold. It is considered to be the ‘gold futures ‘price, but it is not even the future price of gold since no one can predict with absolute certainty what the future price of gold is going to be. The future gold price is what the price of gold will be at some time in the future. Not something easily predicted with the amount of factors and variables that can affect the price.

On what does the gold price depend? Well it does not depend on the value of gold as that is remarkably unchanged over the years. The value of gold as seen through what you can exchange it for has remained relatively the same for hundreds of years. Of course there are fluctuations and slight variations from time to time, but essentially the value of gold has not changed.

The price of gold is dependent more upon the value of the currency by which the price of gold measured. When the perceived value of the currency rises or falls, the price of gold is affected and is reflected in that price. This does not affect the value of the gold, only the quantity of currency needed to purchase it or for which it can be sold. Important to note when it comes to buying gold.

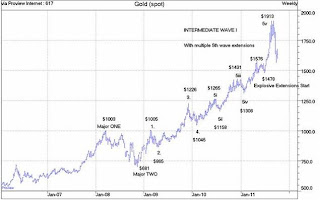

Not withstanding the above, there are attempts, naturally enough, to predict the price of gold and one of these methods is by the use of the Elliott Wave Theory. The Elliott Wave Theory is a way or method of predicting, or forecasting, the trends of financial market cycles by pinpointing extremes in investor psychology along with various other factors.

According to Wikipedia: 'Ralph Nelson Elliott (1871–1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call Elliott waves, or simply waves. Elliott published his theory of market behavior in the book The Wave Principle in 1938'

This theory has been applied to the price of gold with some interesting results.

At the recent Gold Symposium in Sydney, Alf Field, a noted gold expert stated in a 6500 word keynote speech, "The Elliott Wave Theory (EW) gives superb results in predicting the gold price. [While] it is a complicated system with many difficult rules [which] I explain in simple terms in this article, [I have determined that] once this present correction in gold has been completed it should [undergo] the largest and strongest wave in the entire gold bull market. The target for this wave should be around $4,500 with only two 13% corrections on the way."

His almost an hour explanation of this included a number of charts showing how the gold has moved over the past 40 years and that it follows the Elliott Wave Theory almost exactly.

This is a prediction, based on past activity and assumes that the trends and activity will continue. Other prediction methods include taking into account the existing economic trends and activities, changing perceptions of gold in this uncertain economic climate and the value of gold based on supply and demand.

Regardless of the method used or the study and analysis undertaken it seems evident that, as the value of currency deteriorates, the gold price will continue its upward movement requiring more currency to buy gold than it ever did.

This means that now is a good time to buy gold if one wants to retain and preserve one's assets in these uncertain economic times.

On what does the gold price depend? Well it does not depend on the value of gold as that is remarkably unchanged over the years. The value of gold as seen through what you can exchange it for has remained relatively the same for hundreds of years. Of course there are fluctuations and slight variations from time to time, but essentially the value of gold has not changed.

The price of gold is dependent more upon the value of the currency by which the price of gold measured. When the perceived value of the currency rises or falls, the price of gold is affected and is reflected in that price. This does not affect the value of the gold, only the quantity of currency needed to purchase it or for which it can be sold. Important to note when it comes to buying gold.

Not withstanding the above, there are attempts, naturally enough, to predict the price of gold and one of these methods is by the use of the Elliott Wave Theory. The Elliott Wave Theory is a way or method of predicting, or forecasting, the trends of financial market cycles by pinpointing extremes in investor psychology along with various other factors.

According to Wikipedia: 'Ralph Nelson Elliott (1871–1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call Elliott waves, or simply waves. Elliott published his theory of market behavior in the book The Wave Principle in 1938'

This theory has been applied to the price of gold with some interesting results.

At the recent Gold Symposium in Sydney, Alf Field, a noted gold expert stated in a 6500 word keynote speech, "The Elliott Wave Theory (EW) gives superb results in predicting the gold price. [While] it is a complicated system with many difficult rules [which] I explain in simple terms in this article, [I have determined that] once this present correction in gold has been completed it should [undergo] the largest and strongest wave in the entire gold bull market. The target for this wave should be around $4,500 with only two 13% corrections on the way."

His almost an hour explanation of this included a number of charts showing how the gold has moved over the past 40 years and that it follows the Elliott Wave Theory almost exactly.

This is a prediction, based on past activity and assumes that the trends and activity will continue. Other prediction methods include taking into account the existing economic trends and activities, changing perceptions of gold in this uncertain economic climate and the value of gold based on supply and demand.

Regardless of the method used or the study and analysis undertaken it seems evident that, as the value of currency deteriorates, the gold price will continue its upward movement requiring more currency to buy gold than it ever did.

This means that now is a good time to buy gold if one wants to retain and preserve one's assets in these uncertain economic times.

Tuesday, November 22, 2011

Is China cornering the gold market?

Is China out to corner the gold market?

China is currently buying gold as fast as the west can sell it. This appears to be a long term strategy to preserve its wealth in the face oif currency deterioration in the west, primarily in Europe and the US. China carries massive debt from the west and is evidently looking to convert this debt to asset value as the value of debt deteriorates.

The Chinese government is now encouraging its citizens to invest in gold as well as itself buying up all the gold it can get its hands on.

According to Paul Mylchreest's Thunder Road Report, China is pushing the idea of buying gold and silver for investment purposes to its citizens virtually in the same way that Western media sells soap powder and comments that, "If 1.3 billion Chinese citizens start buying gold and silver, even in tiny quantities, imagine what that will do to the market!"

The report also notes China's Central Television, has been running a news program actively encouraging its citizens to buy gold and showing how easy it is to buy gold as an investment. Even on silver investment the news announcer is quoted as saying, " China has introduced its first ever investment opportunity for silver bullion. The bars are available in 500g, 1kg, 2kg and 5kg with a purity of 99.9%. Figures show that gold was fifty times more expensive than silver in 2007, but now that figure has reached over seventy times.

Analysts say that silver has been undervalued in recent years. They add that the metal is the right investment for individual investors and could be a good way to cash in."

Paul ends the piece on Chinese gold and silver potential with the following quote from Christine Verone, the first (and only) foreigner in the country to become a certified "expert" on the Chinese gold markets, a designation awarded exclusively by the Shanghai Gold Exchange...and also the first foreigner in history to ever be licensed in any professional capacity by a Chinese commodity exchange.

"Simply put, the Chinese government is trying to trigger a national gold craze...and its working. The Chinese public now has gold trading platforms on steroids.... ...Also, for the first time in history, Chinese investors can even trade gold abroad (in London) with the swipe of a 'Lucky Gold' card. I can't even get Bank of America to open a foreign currency account."

The existing LMBA and New York gold markets will also pale into insignificance if the Chinese gold market takes off. With the Chinese population now surpassing 1,338,299,000 the potential for the gold price to rise to astronomical heights is becoming more real each day.

Especially with the recently opened Pan Asian Gold Exchange (PAGE) enabling buyers to bypass the bullion banks and the LBMA as well as open the door for the international investor to buy renminbi. The financialsense.com website recently pointed out, "PAGE also provides a new way for international investors to own Chinese currency - the Renminbi (RMB). Here's how: The buyers will purchase gold contracts denominated in RMB. They can then hedge out the gold in the dollar-based gold markets. As a result, they effectively own RMB.

"We see here yet another example of multiple Beijing initiatives opening the RMB to world investors. Over time, these innovations will enhance the value of the RMB and create a deeper, more liquid foreign exchange presence for the Chinese currency. PAGE is another internationalization step forward for the RMB in the direction of world reserve currency status.

"The advantages of being the world reserve currency, as well as the responsibilities involved, have not been lost in the Chinese government."

If China is indeed actively working on cornering the gold market, perhaps now is a good time to buy gold while it is still cheap and available.

China is currently buying gold as fast as the west can sell it. This appears to be a long term strategy to preserve its wealth in the face oif currency deterioration in the west, primarily in Europe and the US. China carries massive debt from the west and is evidently looking to convert this debt to asset value as the value of debt deteriorates.

The Chinese government is now encouraging its citizens to invest in gold as well as itself buying up all the gold it can get its hands on.

According to Paul Mylchreest's Thunder Road Report, China is pushing the idea of buying gold and silver for investment purposes to its citizens virtually in the same way that Western media sells soap powder and comments that, "If 1.3 billion Chinese citizens start buying gold and silver, even in tiny quantities, imagine what that will do to the market!"

The report also notes China's Central Television, has been running a news program actively encouraging its citizens to buy gold and showing how easy it is to buy gold as an investment. Even on silver investment the news announcer is quoted as saying, " China has introduced its first ever investment opportunity for silver bullion. The bars are available in 500g, 1kg, 2kg and 5kg with a purity of 99.9%. Figures show that gold was fifty times more expensive than silver in 2007, but now that figure has reached over seventy times.

Analysts say that silver has been undervalued in recent years. They add that the metal is the right investment for individual investors and could be a good way to cash in."

Paul ends the piece on Chinese gold and silver potential with the following quote from Christine Verone, the first (and only) foreigner in the country to become a certified "expert" on the Chinese gold markets, a designation awarded exclusively by the Shanghai Gold Exchange...and also the first foreigner in history to ever be licensed in any professional capacity by a Chinese commodity exchange.

"Simply put, the Chinese government is trying to trigger a national gold craze...and its working. The Chinese public now has gold trading platforms on steroids.... ...Also, for the first time in history, Chinese investors can even trade gold abroad (in London) with the swipe of a 'Lucky Gold' card. I can't even get Bank of America to open a foreign currency account."

The existing LMBA and New York gold markets will also pale into insignificance if the Chinese gold market takes off. With the Chinese population now surpassing 1,338,299,000 the potential for the gold price to rise to astronomical heights is becoming more real each day.

Especially with the recently opened Pan Asian Gold Exchange (PAGE) enabling buyers to bypass the bullion banks and the LBMA as well as open the door for the international investor to buy renminbi. The financialsense.com website recently pointed out, "PAGE also provides a new way for international investors to own Chinese currency - the Renminbi (RMB). Here's how: The buyers will purchase gold contracts denominated in RMB. They can then hedge out the gold in the dollar-based gold markets. As a result, they effectively own RMB.

"We see here yet another example of multiple Beijing initiatives opening the RMB to world investors. Over time, these innovations will enhance the value of the RMB and create a deeper, more liquid foreign exchange presence for the Chinese currency. PAGE is another internationalization step forward for the RMB in the direction of world reserve currency status.

"The advantages of being the world reserve currency, as well as the responsibilities involved, have not been lost in the Chinese government."

If China is indeed actively working on cornering the gold market, perhaps now is a good time to buy gold while it is still cheap and available.

Saturday, November 19, 2011

Fake Gold Coins Flood the Markets

Fake gold and silver coins are flooding the market, mostly from China.

With precious metals prices poised to be the biggest price explosion in centuries, fake gold and silver products are becoming a booming industry say Global Piracy & Counterfeiting Consultants (GP&CC).

According to GP&CC, "One Chinese counterfeiter openly bragged about producing 100,000 fake U.S. Silver Dollars per year, and that’s just one counterfeiter. There are many others jumping on the band wagon.

Some of the Chinese counterfeit coins are of very high quality, making it difficult for even some experts to tell the difference. And worse, the U.S. Federal Government is a no show-once again."

Most fake coins can be detected by their weight which will be different to the genuine article. In addition the milled edges on fakes are slanted and not vertical.

Also deal with multiple established dealers who have been around for many years.

When you buy from one dealer, get your gold and silver coins appraised by another independent appraiser. If you’ve invested $10000.00 into precious metals, the additional 100 or so cost to have your investment appraised is a small price to pay to verify the authenticity of your coins.. If you were sold a fake, you can then take immediate action against the offending dealer. It is illegal to sell fake gold and silver coins in the US and in most other western countries so most dealers will make a point of ensuring their coins are genuine.

Knowing the dimensions, weight and exactly how your gold and silver coins should look is important also. Doing your own due diligence is a must.

Despite fake gold and silver coins flooding the market you can still take steps to protect yourself. Don’t let the fact that counterfeits are out there dissuade you from making a good investment decision. Buying gold is still an excellent way to preserve asset value.

With precious metals prices poised to be the biggest price explosion in centuries, fake gold and silver products are becoming a booming industry say Global Piracy & Counterfeiting Consultants (GP&CC).

According to GP&CC, "One Chinese counterfeiter openly bragged about producing 100,000 fake U.S. Silver Dollars per year, and that’s just one counterfeiter. There are many others jumping on the band wagon.

Some of the Chinese counterfeit coins are of very high quality, making it difficult for even some experts to tell the difference. And worse, the U.S. Federal Government is a no show-once again."

Most fake coins can be detected by their weight which will be different to the genuine article. In addition the milled edges on fakes are slanted and not vertical.

Also deal with multiple established dealers who have been around for many years.

When you buy from one dealer, get your gold and silver coins appraised by another independent appraiser. If you’ve invested $10000.00 into precious metals, the additional 100 or so cost to have your investment appraised is a small price to pay to verify the authenticity of your coins.. If you were sold a fake, you can then take immediate action against the offending dealer. It is illegal to sell fake gold and silver coins in the US and in most other western countries so most dealers will make a point of ensuring their coins are genuine.

Knowing the dimensions, weight and exactly how your gold and silver coins should look is important also. Doing your own due diligence is a must.

Despite fake gold and silver coins flooding the market you can still take steps to protect yourself. Don’t let the fact that counterfeits are out there dissuade you from making a good investment decision. Buying gold is still an excellent way to preserve asset value.

Thursday, November 03, 2011

A seven million dollar gold iPad

Luxury goods specialist Stuart Hughes has created the Gold History Edition iPad 2. It weighs two and a half kilos, nearly five times that of an ordinary iPad and at $7,708,000 is one of the most expensive gadgets around.

According to Stuart Hughes, This is a solid gold and diamond iPad. 'Encrusted with 25.5 carats of 'IF' Flawless diamonds, a magnificent total of 53 individually set sparkling gems dwell beautifully in their solid 22ct Apple logo. The rear and screen surround are made from a single piece of solid 22ct gold, weighing an immense 2,100 grams. This most luxurious iPad appearance is outstanding even down to the precise polishing to reveal its most beautiful harmonious appearance. A magnificent combination of top of the industry technology and unrivalled craftsmanship was involved in creating this masterpiece.'

The frame work is made from a 75 million year old stone called Ammolite which has a 65 million year old portion of Tyrannosaurus Rex thigh bone shaved into it.

The iPad used is the Wi-Fi & 3G, 64GB version. This item is a limited edition of only 10 units to be made, but only two have been manufactured so far, with one sold to an anonymous buyer already.

One wit mentioned that once iPad 3 is issued, it will be out of date.

Other devices customised by Hughes include a gold and diamond-encrusted Nintendo Wii worth $460,000 and an iPhone 4 valued at over $7,000,000.

According to Stuart Hughes, This is a solid gold and diamond iPad. 'Encrusted with 25.5 carats of 'IF' Flawless diamonds, a magnificent total of 53 individually set sparkling gems dwell beautifully in their solid 22ct Apple logo. The rear and screen surround are made from a single piece of solid 22ct gold, weighing an immense 2,100 grams. This most luxurious iPad appearance is outstanding even down to the precise polishing to reveal its most beautiful harmonious appearance. A magnificent combination of top of the industry technology and unrivalled craftsmanship was involved in creating this masterpiece.'

The frame work is made from a 75 million year old stone called Ammolite which has a 65 million year old portion of Tyrannosaurus Rex thigh bone shaved into it.

The iPad used is the Wi-Fi & 3G, 64GB version. This item is a limited edition of only 10 units to be made, but only two have been manufactured so far, with one sold to an anonymous buyer already.

One wit mentioned that once iPad 3 is issued, it will be out of date.

Other devices customised by Hughes include a gold and diamond-encrusted Nintendo Wii worth $460,000 and an iPhone 4 valued at over $7,000,000.

Tuesday, November 01, 2011

Real Gold Spun Ties

The result of ten years of work with EMPA Technology has resulted in clothes now made out of high tech gold material rather like the finest of silk yet made of gold.

In this technology gold is sprayed onto polyester in a plasma coating plant. About the size of a normal refrigerator, inside a small piece of gold is sprayed with fast moving argon ions resulting in atoms of gold being knocked off the gold piece and landing on polyester fibre being slowly pulled through the machine. Once the atoms of gold adhere to the surface of the polyester they cannot be removed and so the polyester is suitable for weaving into ties, handkerchiefs and what ever else takes your fancy.

Currently just enough material has been manufactured for three ties and a dozen more available by Christmas 2011. "The first, worldwide exclusive series, tailored in the Zürich tie manufactory Hofmann und Co AG will be on offer to gentlemen with an exclusive sense of style at Swiss francs 7500 apiece." A Christmas present that is very unlikely to be refused.

How much gold is in a gold tie you might ask? According to the textile specialists, a textile panel large enough to make three ties is coated with 25 grams of pure, 24 carat gold. Each tie therefore glows with 8 grams of gold. However it is a very slow process with only enough material being made each year to manufacture less than 600 panels. A lot of the material is also reserved for various project partners such as the Jakob Schlaepfer Company, embroiderers and manufacturers of decorative textiles, who will use the gold yarn for items in its Winter 2012/13 Haute Couture collection.

These gold spun ties are possibly the most expensive gold in the world.

In this technology gold is sprayed onto polyester in a plasma coating plant. About the size of a normal refrigerator, inside a small piece of gold is sprayed with fast moving argon ions resulting in atoms of gold being knocked off the gold piece and landing on polyester fibre being slowly pulled through the machine. Once the atoms of gold adhere to the surface of the polyester they cannot be removed and so the polyester is suitable for weaving into ties, handkerchiefs and what ever else takes your fancy.

Currently just enough material has been manufactured for three ties and a dozen more available by Christmas 2011. "The first, worldwide exclusive series, tailored in the Zürich tie manufactory Hofmann und Co AG will be on offer to gentlemen with an exclusive sense of style at Swiss francs 7500 apiece." A Christmas present that is very unlikely to be refused.

How much gold is in a gold tie you might ask? According to the textile specialists, a textile panel large enough to make three ties is coated with 25 grams of pure, 24 carat gold. Each tie therefore glows with 8 grams of gold. However it is a very slow process with only enough material being made each year to manufacture less than 600 panels. A lot of the material is also reserved for various project partners such as the Jakob Schlaepfer Company, embroiderers and manufacturers of decorative textiles, who will use the gold yarn for items in its Winter 2012/13 Haute Couture collection.

These gold spun ties are possibly the most expensive gold in the world.

Royal Canadian Mint's New Gold ETRs Program

The Royal Mint is introducing a new gold ETR program of Exchange Traded Receipts (ETRs) under the Mint's new Canadian Gold Reserves program. According to the Mint, 'Each ETR provides evidence of ownership in physical gold bullion held in the custody of the Mint at its facilities in Ottawa, Ontario. The Canadian Gold Reserves program marks the expansion of the Mint's successful core bullion and refinery business.'

"We believe that this new program will build on our reputation and continued success as a world-class custodian of precious metals," said Ian E. Bennett, President and CEO of the Royal Canadian Mint. "With the introduction of the Canadian Gold Reserves ETR program we hope that investors will see this as a convenient, efficient and secure method for investing in and owning physical gold."

Unlike gold ETFs and some other gold investment products the owner of the gold ETR actually owns the gold and not just a share in an entity that owns the gold.

The Issue price will be 20 Canadian Dollars and the amount of gold for that will be determined at the closing date which will be in late November. This will be a prospectus exempt issue and, subject to the usual conditions will be listed on the Toronto Stock Exchange with trade commencing on the closing day of the offer.

Unlike Gold ETFs, ETR holders will be entitled to redeem their ETRs if required in the form of 99.99 percent pure gold bars, coins or cash all of which will be based on the future gold price or market price of the ETRs at the time of redemption or sale.

ETRs will not be available for sale in the USA, this is a Canadian initiative only and will be available only through investment dealers led by TD Securities Inc. and National Bank Financial Inc., and including BMO Nesbitt Burns Inc., CIBC World Markets Inc., RBC Dominion Securities Inc., Canaccord Genuity Corp., Cormark Securities Inc., MGI Securities Inc. and Raymond James Ltd. to distribute the ETRs on a best efforts agency basis.

For Canadians the Royal Canadian Mint's New Gold ETRs Program could be a good way to buy gold.

"We believe that this new program will build on our reputation and continued success as a world-class custodian of precious metals," said Ian E. Bennett, President and CEO of the Royal Canadian Mint. "With the introduction of the Canadian Gold Reserves ETR program we hope that investors will see this as a convenient, efficient and secure method for investing in and owning physical gold."

Unlike gold ETFs and some other gold investment products the owner of the gold ETR actually owns the gold and not just a share in an entity that owns the gold.

The Issue price will be 20 Canadian Dollars and the amount of gold for that will be determined at the closing date which will be in late November. This will be a prospectus exempt issue and, subject to the usual conditions will be listed on the Toronto Stock Exchange with trade commencing on the closing day of the offer.

Unlike Gold ETFs, ETR holders will be entitled to redeem their ETRs if required in the form of 99.99 percent pure gold bars, coins or cash all of which will be based on the future gold price or market price of the ETRs at the time of redemption or sale.

ETRs will not be available for sale in the USA, this is a Canadian initiative only and will be available only through investment dealers led by TD Securities Inc. and National Bank Financial Inc., and including BMO Nesbitt Burns Inc., CIBC World Markets Inc., RBC Dominion Securities Inc., Canaccord Genuity Corp., Cormark Securities Inc., MGI Securities Inc. and Raymond James Ltd. to distribute the ETRs on a best efforts agency basis.

For Canadians the Royal Canadian Mint's New Gold ETRs Program could be a good way to buy gold.

Subscribe to:

Comments (Atom)